Why Invest in

HANA Materials?

Semiconductor prosperity and increased demand

Strengthening existing businesses through preemptive investments

Securing a foundation for future growth by diversifying products and markets

Since 2007, we have continued to grow into a leading company in material parts that aims to be the best in the world and constantly pursues unique technologies with the goal of providing the world's best semiconductor parts and material solutions.

2023 Financial Figures

Net sales

Operating Profit

Earnings per share

Reinforcement of Existing Business

We have secured all of the major global semiconductor equipment companies as customers by continuously securing patents and original technologies. We continue to strive for success through our company-wide innovation activities such as quality, process, work environment, system, as well as pro-active customer service.

Reinforced leadership in SiC/Si parts capacity

Diversification of new materials and parts

Securing manufacturing/quality competitiveness

Pursuit of Absolute Quality

Our top priorities include technology development and quality improvement. As quality issues have become more and more important due to the company's growth and technological advancement, we are pursuing a step-by-step strategy to secure absolute quality giving us a competitive advantage over the field.

Relative advantage (customer-oriented quality assurance conversion, partner & outsourcing management, change history management) from 2020

Competitive advantage (quality stabilization, inspection efficiency, self-monitoring, expansion of change history management) from 2021

Absolute quality (global response quality system, receiving A scores in customer evaluations) from 2022

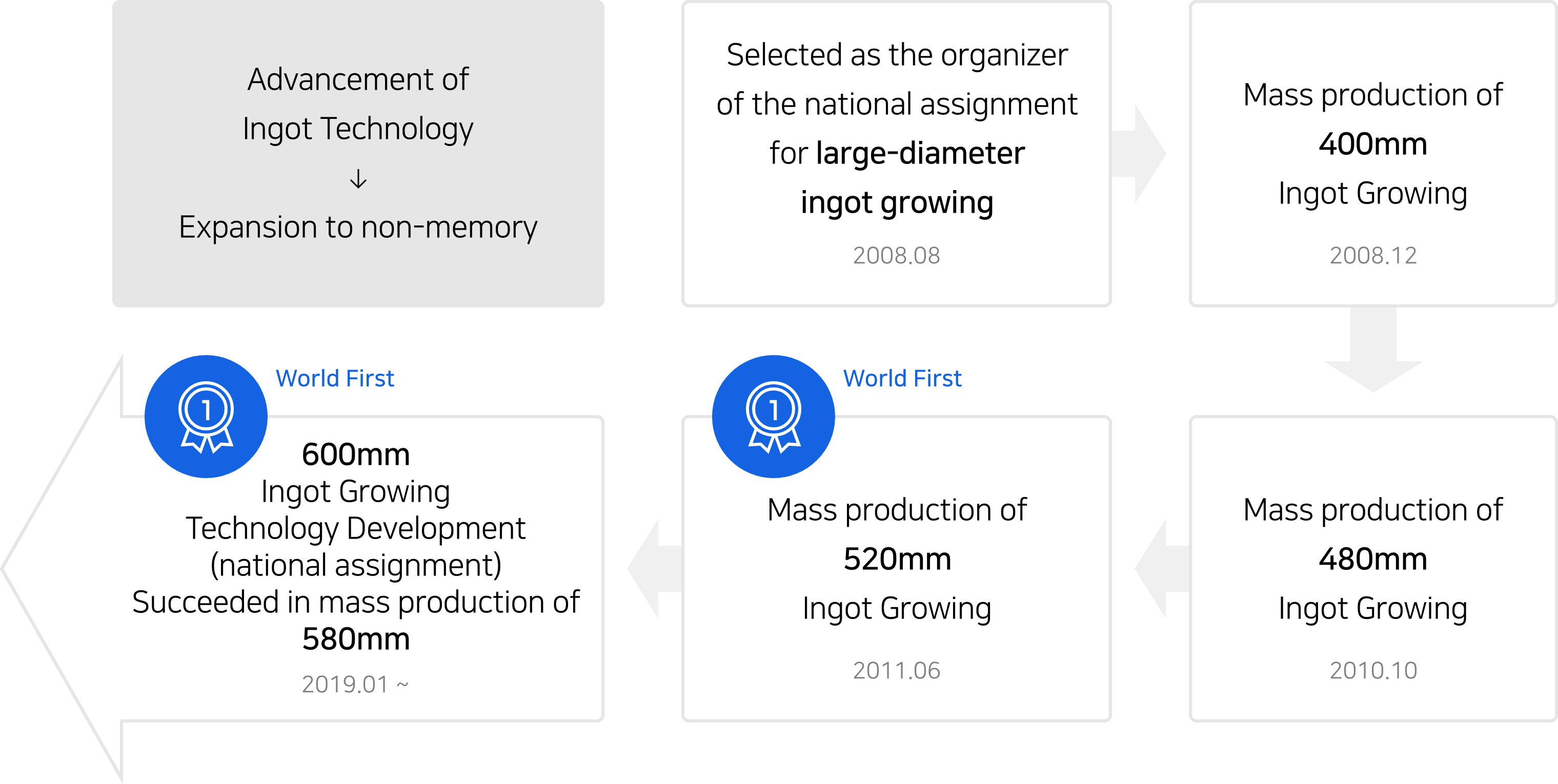

Leading innovative technologies

We have been continuously developing silicon ingot growth technology since 2008 for the localization of materials. In 2021, 600mm silicon ingot technology development was completed for the first time in the world. In addition, we are constantly developing various material technologies such as CVD SiC deposition technology, ultra-precision component processing technology, and silicon anode material to realize our vision as a specialized semiconductor component material company.

Capital Return Policy

Dividend Policy

As part of the shareholder return policy, the dividend policy has been changed to twice a year by implementing half-yearly dividends from 2021.

In addition, through a resolution of the board of directors on January 4, 2023, it was decided to maintain the dividend payout ratio at 10% or higher for the 2022-2025 business year within the limit of dividend payment profit.

However, if free cash flow is less than KRW 10 billion, dividend payment may be reduced or not paid. (Free cash flow: cash flow from operating activities - acquisition of tangible assets)

Past dividend-related status is shown in the table below.

Categorize

Dividend(per share)

Annualized payout(billion)

Dividend payout ratio(%)

Dividend yield(%)

2023

200 won

39

11.5

0.4

2022

600 won

117.1

14.6

1.8

2021

600 won

117.1

17.5

1.0

2020

300 won

58.2

15.4

1.1

2019

200 won

38.9

14.1

1.1

Total number of shares : Total number of shares: 19,516,840 shares excluding treasury shares (220,834 shares) out of 19,737,674 shares

Dividend payout ratio (%): Total dividend / Net income

Sitemap

Links

HANA MICRON

HANA Materials Inc.

/

50, 3gongdan 3-ro, Seobuk-gu, Cheonan-si, Chungcheongnam-do

/ TEL 041-410-1015

Copyright (c) 2022 HANA Materials Inc. All Rights Reserved.